Stop fraud in real-time with graph intelligence

Loci is a fraud defense engine powered by the Fraud Language Model (FLM). It combines the clarity of rules with the nuance of models — detecting threats in real-time, cutting false positives, and meeting regulatory demands at scale

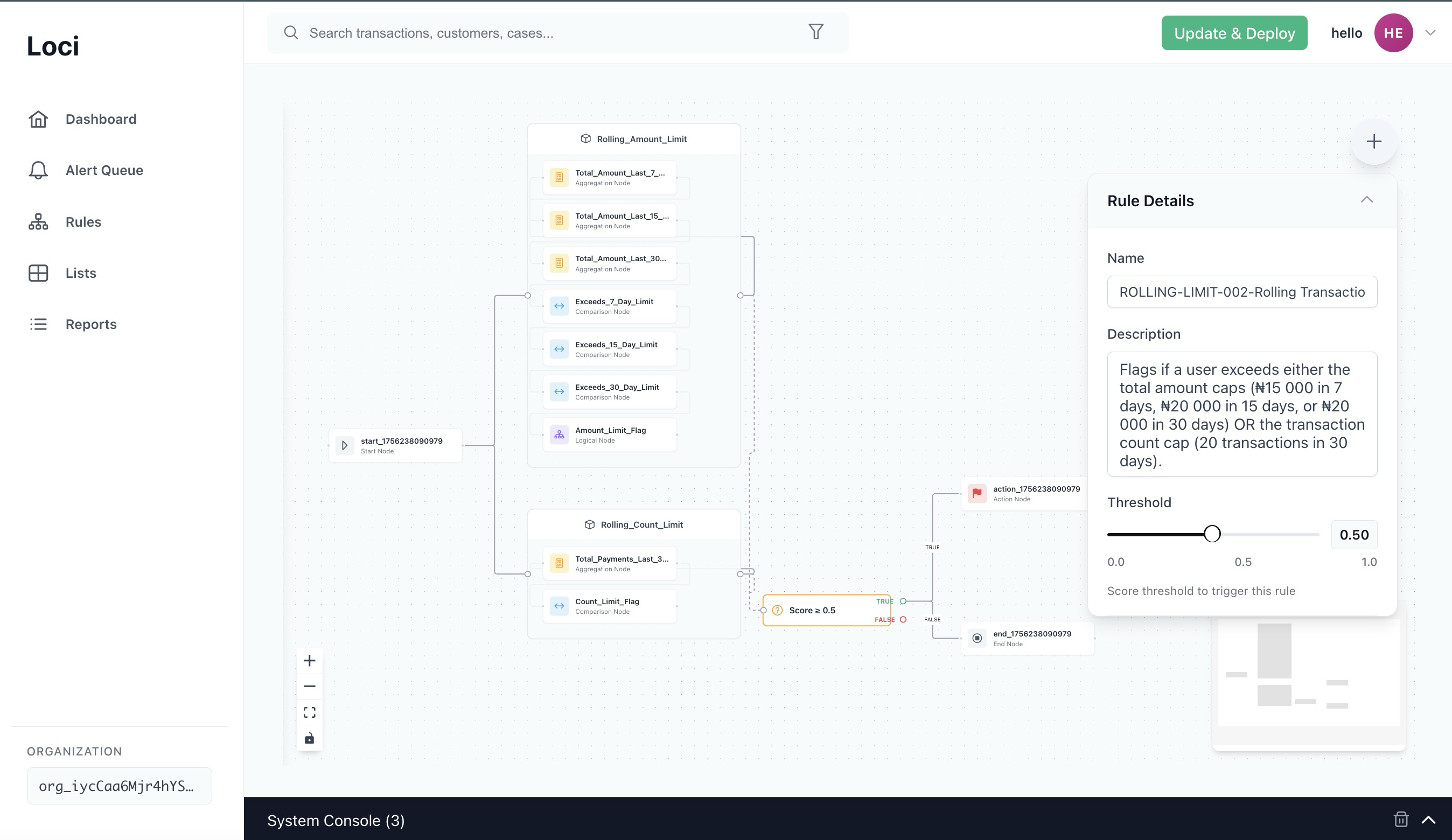

Real-Time Decision Flow

Built for modern fraud teams

Everything you need to detect, prevent, and investigate fraud at scale, without compromising on speed or accuracy.

MADIE Decision Engine

High-performance core processes complex rules in less than a second. Graph-based execution ensures efficient, ordered processing.

Auto-Grapher AI

Automatically discovers hidden fraud patterns from your historical data, ranking them by precision and recall to suggest new rules.

No-Code Model Builder

Convert natural language descriptions into production-ready rules. Visual DAG editor with iterative self-correction ensures high reliability.

How Loci Works

From transaction to decision in three simple, powerful steps.

Ingest & Enrich

Connect via API or Kafka. Automatically calculate z-scores, velocity, and temporal features in real-time.

Evaluate & Decide

MADIE engine processes rules as DAGs, executing complex logic for sub-second decisions.

Learn & Adapt

Auto-Grapher continuously mines patterns, suggests new rules, and adapts to emerging fraud tactics.

Developer-First API

Integrate Loci's powerful decision engine with a single, straightforward API call. Get rich, explainable fraud scores in real-time. Our clear documentation and simple data structure mean you can go live in hours, not weeks.

Read API Docs{

"transaction_id": "TX900000600144",

"entity_id": "E00018",

"amount": 1560.00,

"currency": "NGN",

"source_account_number": "1231231231",

"beneficiary_account_number": "7100000006",

...

}{

"success": true,

"decision": "review",

"fraud_score": 20,

"explanations": [

{

"rule": "LIFECYCLE_COMPOSITE_001",

"triggered": true,

"contribution": 9.65,

"reason": "Lifecycle anomaly detected."

},

{

"rule": "High Amount Withdrawal Check",

"triggered": true,

"contribution": 6.95,

"reason": "Amount is suspiciously high."

}

],

...

}Start detecting fraud in real-time

Join leading financial institutions using Loci to protect millions in transactions.